Trying to figure out how to file taxes as a freelance photographer? Check this high-level guide to help you through.

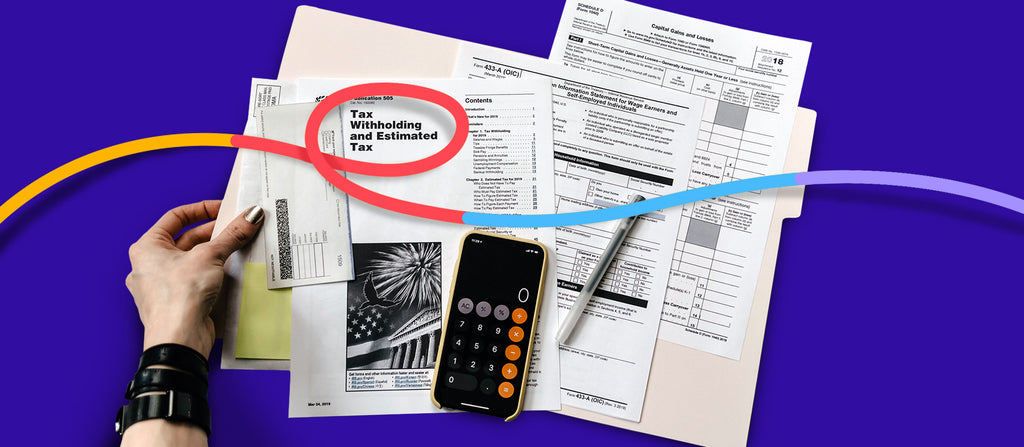

While working for yourself comes with countless perks, there’s one major downside: You’re responsible for withholding and paying your own taxes.

Preparing and filing freelance tax can be complicated for self-employed photographers. To help you navigate this process, we’ve compiled a tax guide for photographers to get you started.

How to file taxes as a freelance photographer

Start with small business recordkeeping

Before moving forward, set yourself up for success by keeping good records of everything — and we mean everything.

Some of the records and receipts you need to set aside include:

- Receipts for business-related expenses (don’t worry, we’ll detail deductible expenses later)

- Invoices

- Payroll records for full-time or contract employees

- Bank statements

- Any W2 or 1099 forms from employers

- Previous income tax returns

While you can hang onto all this paperwork in a shoebox for your accountant to sort out, we recommend getting organized. Set up a proper paper filing system or use an accounting tool like Wave or QuickBooks to digitize, store, and categorize paper receipts and track invoices.